The Current State of Private Equity

Private Equity and the Golden Era of SMB

Next week, we will be publishing our first memo on a sector consolidation thesis in the Testing, Inspection, and Certification (TIC) market. Ahead of that, we wanted to publish a primer on why niche markets matter. This newsletter will highlight small, fragmented markets that are ripe for consolidation. In order to understand where the opportunity lies, it’s important to evaluate how the Private Equity market has transformed over the past ten years, and why it’s leading us into the Golden Era of SMB.

PE Evolution: Why it’s creating The Golden Era of SMB.

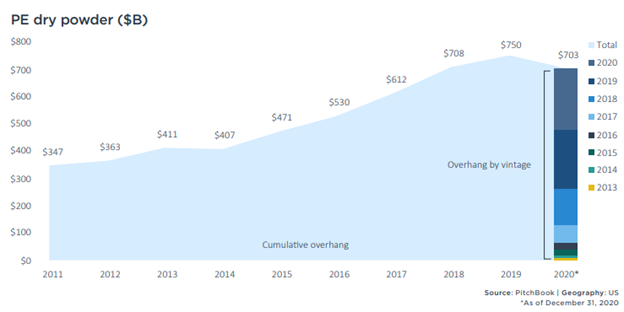

It’s a pretty well-known phenomena: LPs have increased capital allocation into private equity, rotating out of assets with lower returns. Dry powder has continued to build, peaking in 2019 at $750 billion.

Due to increased asset allocations to private equity, we’ve increasingly seen more (and more… and more…) competition for deals. Alongside other factors (e.g, interest rates, new GPs, etc.) purchase price multiples are increasing - supply (committed capital) continues to outpace demand (quality companies for sale).

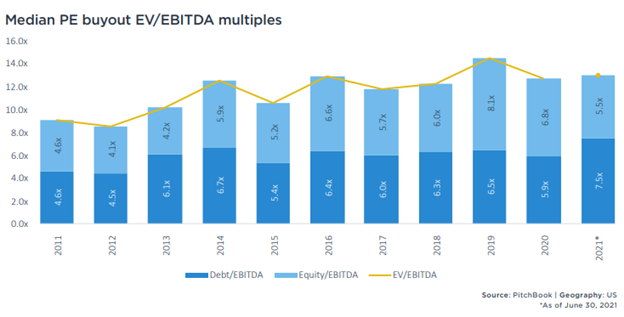

The data supports this – median Enterprise Value to EBITDA multiples increased more than 50% (9.2x in 2011 to 14.6x in 2019). Private credit markets allocations have increased as well, as lower corporate tax rates and interest rates have improved cash-conversion profiles. While maybe not 100% causality, it’s hard not to see the correlation with a substantial increase in total leverage at close (4.6x in 2011 to 7.5x in 2021).

Given the increase in multiples, firms have achieved a reasonable amount of their returns from multiple expansion. I know what you’re thinking - Is this sustainable?

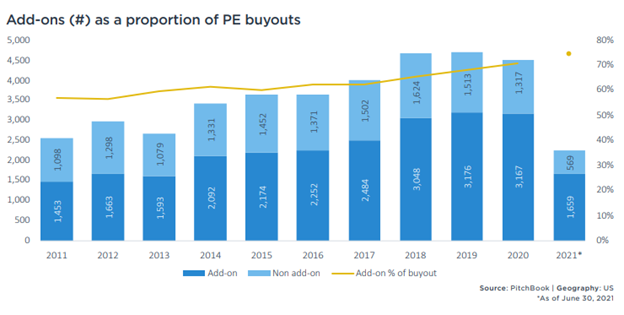

Over the long-term, probably not. However, as markets (and managers) are prone to doing, they evolved. While roll-up strategies are nothing new, the market has shifted to heavy add-on strategies, where platforms are the “best-buyer,” capable of paying a higher price. This results in multiple arbitrage as sub-scale assets, which typically trade at discounted multiple, can be bolted onto an existing platform that has a relatively, higher value due to scale. According to Pitchbook, add-ons represented approximately 56% of PE transactions in 2011, growing to represent approximately 75% of PE transactions in the first half of 2021.

While the market is still in the early innings of the add-on frenzy, the increased competition for smaller deals has led to higher multiples for smaller businesses. The primary beneficiaries of this are small and medium-sized business owners, who have struggled to hand down their blue-collar empires to the next generation.

Where’s it happening?

While the add-on frenzy continues, it will lead to an increase in purchase price multiples for SMB opportunities. The sectors that benefit the most from these consolidation strategies have a few characteristics:

Large, heavily fragmented markets

Recurring, recession-resistant demand drivers

High barriers and benefits to scale

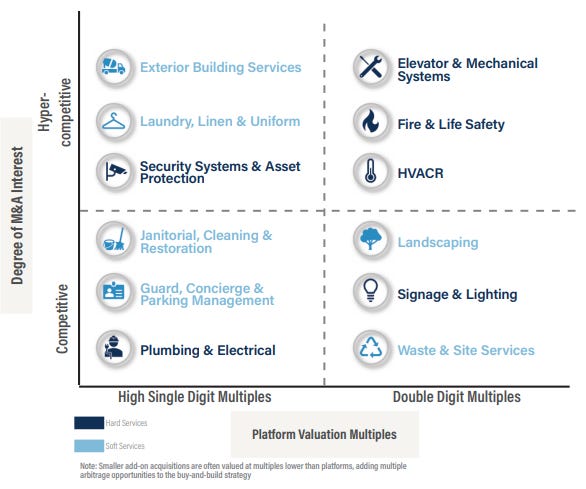

One of the key areas of PE interest in the past few years has been regionally-focused service businesses in large MSAs. Over time, this has led into secondary and tertiary markets, as the search for more scale moves into smaller markets with less desirable growth characteristics. A few examples of services that PE funds have focused on:

With all this in mind, I’m calling this the Golden Era for SMB in America, as private equity firms continue to consolidate these markets. The consolidation cycle is in the early innings and the spread between platforms and add-ons is wide. I’ve seen multiple HVACR and EMS platforms trade at >20x LTM EBITDA and add-ons still trading for around ~5x EBITDA (pre-synergies) in some instances. Such a gap will not persist in perpetuity but will shrink in the coming years.

I plan to go into the synergies components in subsequent posts, but in the interim, I recommend you read Apax Partners’ post on density-driven business models.

I hope you enjoyed the introduction. Please subscribe and lookout for the first memo.

@ValueAddCapital

It would be interesting to jump forward in time 50 years and see the state of PE markets at that point.